The Best Guide To Clark Finance Group Mill Park

Table of ContentsClark Finance Group for BeginnersIndicators on Clark Finance Group Mortgage Broker You Need To KnowSee This Report on Clark Finance GroupRefinance Home Loan for Dummies

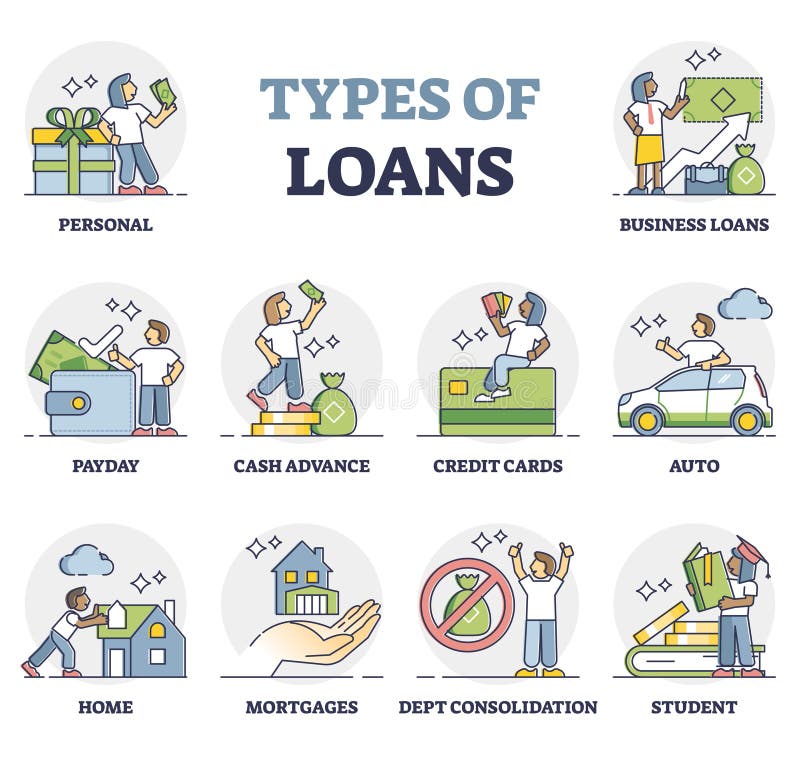

All lendings aren't developed equivalent. If you require to obtain cash, initially, you'll desire to determine which type of financing is ideal for your situation.

If you have high-interest charge card debt, a personal finance may help you settle that financial debt sooner. To settle your financial obligation with an individual funding, you 'd obtain a financing in the amount you owe on your bank card. If you're approved for the complete quantity, you would certainly use the funding funds to pay your credit score cards off, instead making regular monthly repayments on your individual funding.

That's because the lender might take into consideration a secured financing to be less dangerous there's a property supporting your loan. If you don't mind pledging security and also you're certain you can repay your funding, a secured funding may help you conserve cash on interest. When you use your collateral to secure a loan, you risk of losing the residential or commercial property you provided as collateral.

The smart Trick of Clark Finance Group Refinance Home Loan That Nobody is Talking About

A pawn store funding is another fast-cash borrowing option. You'll take a product of worth, like a piece of jewelry or a digital, right into a pawn store and borrow money based on the thing's value. Funding terms differ based upon the pawn shop, and also rates of interest can be high. Some states have actually stepped in to control the market.

You may additionally obtain hit with charges and also added expenses for storage, insurance coverage or renewing your loan term. A payday choice financing is a temporary financing supplied by some government lending institution. A buddy is designed to be much more budget-friendly than a payday advance loan. Payday alternative finance quantities vary from $200 to $1,000, and also they have much longer payment terms than payday advance loans one to 6 months as opposed to the normal few weeks you obtain with a payday advance (Clark Finance Group Refinance Home Loan).

A house equity financing is a kind of safeguarded loan where your home is used as collateral to obtain a round figure of cash. The quantity you can obtain is based upon the equity you have in your house, or the difference in between your home's market worth and also just how much you owe on your home.

Given that you're using your house as collateral, your rate of interest price with a house equity lending might be reduced than with an unprotected individual funding. You can use your house equity car loan for a range of objectives, ranging from house enhancements to medical bills. Prior to taking out a residence equity finance, see to it the settlements are in your budget.

Fascination About Clark Finance Group Home Loan Lender

She enjoys aiding individuals discover methods to much better handle their money. Her job can be located on numerous internet sites, including Bankrate, Finance, Bu Read much more. Find out more.

Below are the most common kinds of fundings and also exactly how they function. Trick Takeaways Personal fundings as well as debt cards come with high rate of interest prices yet do not require collateral.

Cash loan typically have really high rate of interest plus deal costs. Individual Loans Many banks, online as well as on Main Road, provide individual finances, as well as the earnings might be made use of for virtually anything from purchasing a brand-new 4K 3D smart TV to paying expenses. This is a costly method to obtain money, since the lending is unprotected, which indicates that the borrower does not set up security that can be seized in instance of default, similar to a car financing or house mortgage.

The smart Trick of Home Loan Lender That Nobody is Discussing

But interest prices can be greater than three times that amount: Avant's APRs range from 9. 95% to 35. 99%. The very best prices can only be gotten by individuals with phenomenal debt scores and also substantial assets. The worst need to be sustained by people that have nothing else choice. An individual car loan is probably the very best way to go for those who require to obtain a reasonably small quantity of cash as well as are certain they can settle it within a pair of years.

Financial institution Car loan vs. Financial institution Guarantee A small business loan is not the like a bank assurance. A financial institution may provide a guarantee as surety to a third celebration in support of among its clients. If the consumer fails to meet the relevant contractual obligation with the third party, that celebration can require repayment from the financial institution.

A corporation may approve a contractor's bid, as an example, on the condition that the service provider's bank concerns an he has a good point assurance of payment in the occasion that the professional defaults on the agreement. An individual lending may be best for a person who requires to borrow a fairly tiny quantity pool financing of cash and is certain of their capacity to settle it within a couple of years.